Quickstart

Identify profitable products in a supplier-issued price list:

Setup

Open your price list in Excel and ensure the FBA Analytics add-in is installed.

Ensure the following required columns are in the price list:

Barcode/Product identifier e.g. UPC, EAN, ISBN, ...

Supplier Price

Product Name (for easy recognition)

Next, add the necessary columns to calculate the profit per unit.

ASIN Column

To get the product's ASIN use the discovery function

For more details about the discovery function please see: Discovery

Sale Price Column

If you are an FBA seller, then you can get the FBA buy box sale price using:

For more details about the sale price functions please see: Pricing

FBA Fees Column

To get a product's FBA fees use the following:

For more details about the fees functions please see: Fees - FBA Fees

Referral Fees Column

To get a product's referral fees use the following:

For more details about the fees functions please see: Fees - REF Fees

VAT/Taxes

The VAT and taxes you need to pay depend on the country where you are selling, the country where your business is registered, and the type of product you are selling.

To determine the taxes you owe and can reclaim for each product sold, consult resources from your local tax authority.

Amazon Seller Central may also provides tax advice.

Calculating Profit:

To estimate your product per unit, use the following calculation:

Example:

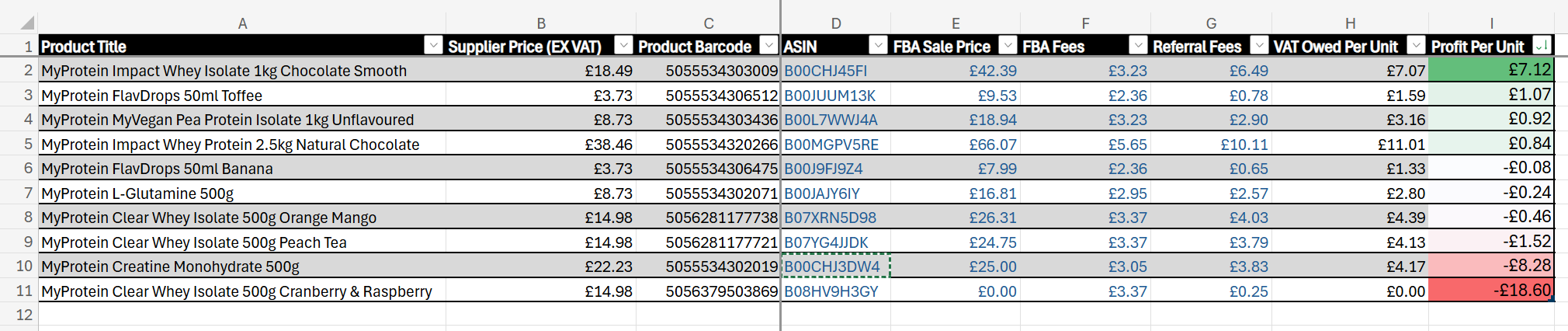

Consider the following supplier price list with FBA Analytics' profit calculations:

All values in blue are calculated by FBA Analytics. See the following breakdown to understand where the values came from